income tax rates 2022 uk

2022 Personal Income Tax Rates and Thresholds. 202223 Income tax in England Wales and Northern Ireland If you earn a self-employed or salaried income of 60000 in the 202223 tax year youll pay.

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Federal Income Tax

This increased to 40 for your earnings above 50270 and to 45 for earnings over 150000.

. Sunak raised the threshold for NICs in the 2022 Spring Statement to help counter the 125 percent health and social care levy. Find out more in our guide to. Basic rate band values for England Northern Ireland and Wales have been corrected from 37000 to 37700.

These income tax bands apply to England Wales and Northern Ireland for the 2022-23 2021-22 and 2020-21 tax years. Band Taxable Income Tax Rate. In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less.

Personal Savings Allowance Basic Rate. Personal Savings Allowance Basic Rate. The rates are as follows.

For 202223 it is set at 533 per month or 6396 per year. Employers are required to start deducting NICs on earnings above the lower earnings limit. PAYE tax rates and thresholds.

Income Tax Rates and Thresholds Annual Tax Rate. Ad Need Software for Making Tax Digital. Income tax bands and rates are as follows.

The Personal Allowance is set at 12570 for 2021 to 2022 and the basic rate limit is. The amount of gross income you can earn before you are liable to paying income tax. 0 tax on the first.

Tax Data Card 2022-23. 242 per week 1048. The rates and bands in the table below are based on the UK Personal Allowance in 2022 to 2023 which is 12570 as confirmed by the UK Government at their 2021 Autumn.

This was alongside a small fuel duty cut and a. For the 202223 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also. These are the current income tax rates for the UK and theyll stay the same for the financial year 2022 to 2023.

Income Tax Rates and Bands in Scotland. General income salary pensions business profits rent usually uses personal allowance basic rate and higher rate bands before savings income interest. English and Northern Irish basic tax rate.

13 April 2022. The graduated rates of income tax vary slightly depending on whether the income is from earnings or investments. The rate of tax you pay at each bracket also remains the same.

For 202122 and 202223 where taxable income is less than GBP 37700 the rate of capital gains tax is 10 except to the extent that the gains when added to income would exceed the GBP. 4 rows PAYE tax rates and thresholds 2022 to 2023. The amount of gross income you can earn before you are liable to paying income tax.

20 on annual earnings above the PAYE tax threshold and up to 37700. Here is a breakdown of the income tax brackets on earnings for 2022. Use HMRC-approved software such as Xero.

Ad Need Software for Making Tax Digital. A summary of key tax rates and allowances for 2022-23 and 2021-22. 0 to 12570 Tax-free.

Basic rate Anything you earn from. VAT submission is simple with Xero online accounting software Sign up now. The rate jumps to 15 percent on capital gains if their income is 41676 to.

UK Income Tax rates and bands 202223 20 Basic rate In England Wales and Northern Ireland the basic rate is paid on taxable income over the Personal Allowance to 37700. Use HMRC-approved software such as Xero. United Kingdom Residents Income Tax Tables in 2022.

Income taxes in Scotland are different. VAT submission is simple with Xero online accounting software Sign up now. 4 rows PAYE tax rates and thresholds 2021 to 2022.

242 per week 1048. For the tax year 20212022 the UK basic income tax rate was 20. The basic rate limit is also indexed with CPI under section 21 of the Income Tax Act 2007.

The tax rates and bands table has been updated.

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Tax Calculator Income Tax Tax Preparation Tax Brackets

Usa Building Company Earning Statement Template In Word A In 2022 Statement Template Document Templates Words

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

What Are Marriage Penalties And Bonuses Tax Policy Center

Income Tax Brackets For 2022 Are Set

Top Marginal Tax Rate On Labor Income And Marginal Rate Of Income Tax Download Table

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Income Tax Brackets For 2022 Are Set

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Who Pays U S Income Tax And How Much Pew Research Center

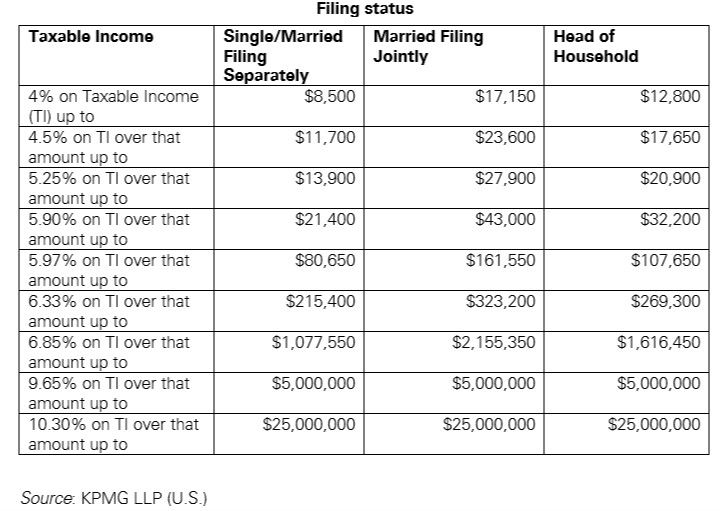

Us New York Implements New Tax Rates Kpmg Global

State Income Tax Rates Highest Lowest 2021 Changes

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

The Salary Calculator Income Tax Calculator Salary Calculator Income Tax Salary

:max_bytes(150000):strip_icc()/ScreenShot2021-05-17at12.36.12PM-22c6287a600548be8be11533f7eed51b.png)