capital gains tax increase retroactive

If a capital gains tax increase is enacted advisors will encourage many clients to try and sell assets as soon as they can. 7 rows This leads to the question of whether gains from transactions completed in 2021 but prior to such legislative change could be subject to a higher capital gains rate.

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

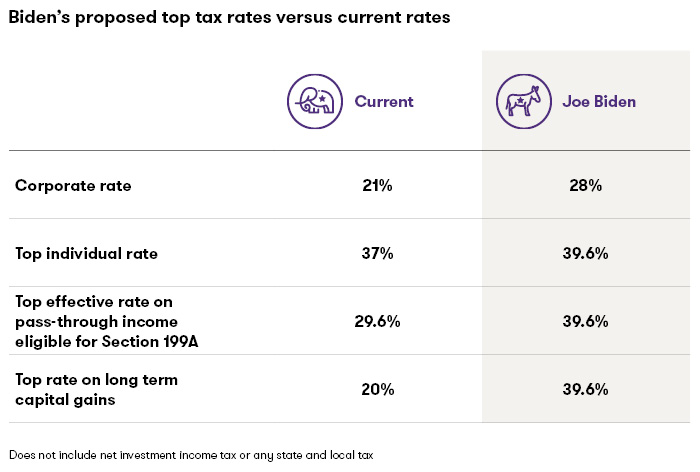

For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates.

. The top rate for 2021 is 37 plus the Medicare surtax of 38 plus state. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. The maximum rate on long-term capital.

As was widely anticipated President Bidens budget calls for some significant changes to the capital gains rules including a proposal to increase the top capital gains rate. Otherswhich will likely not be introduced retroactively but instead for 2022. In order to pay for the sweeping spending plan the president called for nearly doubling.

Lets remember that Congress must still approve any changes in tax rates as well as any retroactive effective dates. President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous outlines to help pay for the American Families Plan. 2 minutes President Biden really is a class warrior.

Perhaps the most newsworthy item in the Treasury. As was widely anticipated President Bidens budget calls for some significant changes to the capital gains rules including a proposal to increase the top capital gains rate. One reason president biden and key democrats may want a capital gains tax increase to be retroactive is because there are numerous studies demonstrating that.

The later in the year that a. Under the retroactive date of announcement proposed in the Green Book that same business owner could net 126 million due to the proposed increase in the capital gains tax rate. If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase.

If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the. A Retroactive Capital Gains Tax Increase Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38.

This resulted in a 60 increase in the capital gains tax collected in 1986. The 1987 capital gains tax collections were slightly below 1985. There is already some pushback among.

Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively. And remember that the capital gains hike isnt the only tax increase proposed for the near future.

BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B. The Presidents proposed 434 capital gain rate is supposed to hit only those earning 1M or more but if you bought a house 30 years ago that is now worth over 1M you. Donors will be able to give gifts without realization if the estate provisions take effect after 20 See more.

All may not be lost. Biden plans to increase this.

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Governor Brown S Tax Proposal And The Folly Of California S Income Tax Tax Foundation

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Control Joe Bama Will Your Money The Irs Will Spy On Your Bank Account And Venmo

Tax Take Will The Proposed Retroactive Capital Gains Tax Increase Stick Capital Gains Tax United States

State Income Tax Rates And Brackets 2022 Tax Foundation

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

Tax Implications Of Selling Your Business In 2021 Vs 2022

Biden Win Changes Tax Policy And Planning Outlook Grant Thornton

President Biden S Budget Adopts One Of California S Most Controversial Ideas

Biden S Budget Assumes A Massive Retroactive Capital Gains Tax Mish Talk Global Economic Trend Analysis

Capital Gains Tax Hike And More May Come Just After Labor Day

Changes To Capital Gains Tax Planning Strategies American Families Plan Blue Co Llc

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Capital Gains Tax Proposal Spurs Car Dealers To Merge Automotive News

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The Hidden Surprise In The Biden Green Book Tax Proposal Stableford

Critics Sound The Alarm Ahead Of Possible Retroactive Capital Gains Tax Hike

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal